As economies come under intense downward pressure, the challenges faced by sales organisations selling complex solutions reach new peaks. The need to demonstrate, immediately, your maximum value to your customers has never been more critical. You may need to re-invent your approach to focus on Growing Complex Sales – Systematically.

A process and methodology to assess the Quality and Value of your offering to your target market: how it rates now, what is it’s potential rating, and what needs to be improved, offers a vital platform for ongoing improvement, and one, that needs to be under your control.

[I refer specifically to “Product”, but the exact same approach is applicable to “Service” offerings.]

The challenges of creating Sales Value

Everyone thinks they have a clear one. Everyone knows you need one. But everybody has a different understanding of what is meant by a value proposition and how to build one. To some, a value proposition is as simple as a tag line. Others a marketing message. Others view it as the quantified financial saving induced by a new project.

It is clear that Sales Value is rarely communicated perfectly. Fournaise Group research found that 95% of Fintech companies would not mainstream because of Messaging, Value Proposition or Product. With everyone interpreting a definition differently, how do you reach a common view that is distinct, clear, repeatable and simple?

It’s incredibly difficult, if not impossible, to produce a concise definition of Sales Value to meet the demands of all internal stakeholders. But it is possible to run a process that subsumes the needs and views of all groups and produces a complete storyboard, common to all teams.

For such a process to be successful it needs the following:

- Structured, consistent approach and methodology

- Quantitative measures

- Viewed, understood and accepted from multiple perspectives

- Creates and measures action points and priorities for improvement

- Determines the value proposition match with the sales model

Establishing a better way: Six Sigma, Kaizen, Marginal Gains

Most systematic business improvement models work from a de-construction of the “solution”: a measurement of current state of each atomic element, a target for immediate and long-term improvement of each element, and a re-construction of the immediate and the strategic potential of “end games”

It is important to note that, through this approach applied to Complex Sales, organizations experience the most immediate gains in an improved storyboard, enhanced messaging, materials, collateral etc., items that are easy and quick to change.

Quick wins are apparent. Self-evidently, strategic product changes have the biggest potential impact on the whole value proposition, but they are also the most complex and slowest changes to implement.

The methodology must lead with, and drive, quick wins.

Growing Complex Sales - Systematically – establishing Metrics to measure “Value”

Frequently, metrics applied to business value dictate, de facto, a financial model ending in a TCO, Payback Period, DCF etc. model. This can only be one element of a complete proposition.

Most elements of “value” are inherently qualitative rather than quantitative; they introduce entirely new technologies or business processes that have no previous metrics. The challenge is to build metrics on qualitative measures and transform them into be specific, quantified, measures.

How do we do this? The STARPAD methodology has a similar approach to a number of established problem-solving models. Simply put, by ranking the Importance of each Value Attribute against its Completeness of Implementation you derive a quantifiable metric, which can then be ranked and actioned.

Diagram 1: STARPAD Methodology

Product View, Marketing View, Customer View, Sales View – who is right?

The biggest danger faced when assessing and evolving Value Propositions is confirmation bias, we always think our work is better than it is. This is especially true for new products and ventures when failure is not perceived to be an option – ie Sales. It should be noted that it is not necessarily a failure when the initial assessment potentially recommends a delay, but delivers a model that has greater and more differentiated strategic value.

To go beyond initial confirmation bias, we have to recognize that different markets, groups, functions, business units and people will all have different perspectives. Whilst there has to be a practical limit to broad and democratic input, modelling the proposition from different viewpoints is essential and always uncovers different ideas and approaches.

In summary, the STARPAD methodology enables input from different constituent groups, most relevantly, the end customer and the sales teams.

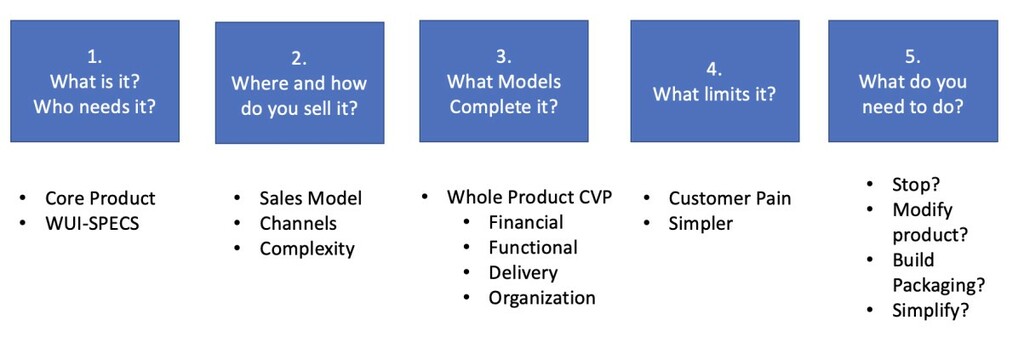

How does the STARPAD methodology flow?

When approaching the challenges of Growing Complex Sales – Systematically, the STARPAD methodology walks the users through the de-construction, assessment and action plans for all product elements impacting the value proposition.

Diagram 2: STARPAD methodology flow.

Simplicity | How do you describe it? |

Paradigm Shift | What change/ business impact does the solution drive? |

Emotional | Who is emotionally connected to the solution and why? |

Compelling | How strong is the financial case? |

Size and Scale | How big is a sale? How does it scale up and out? |

2. The Sales Model

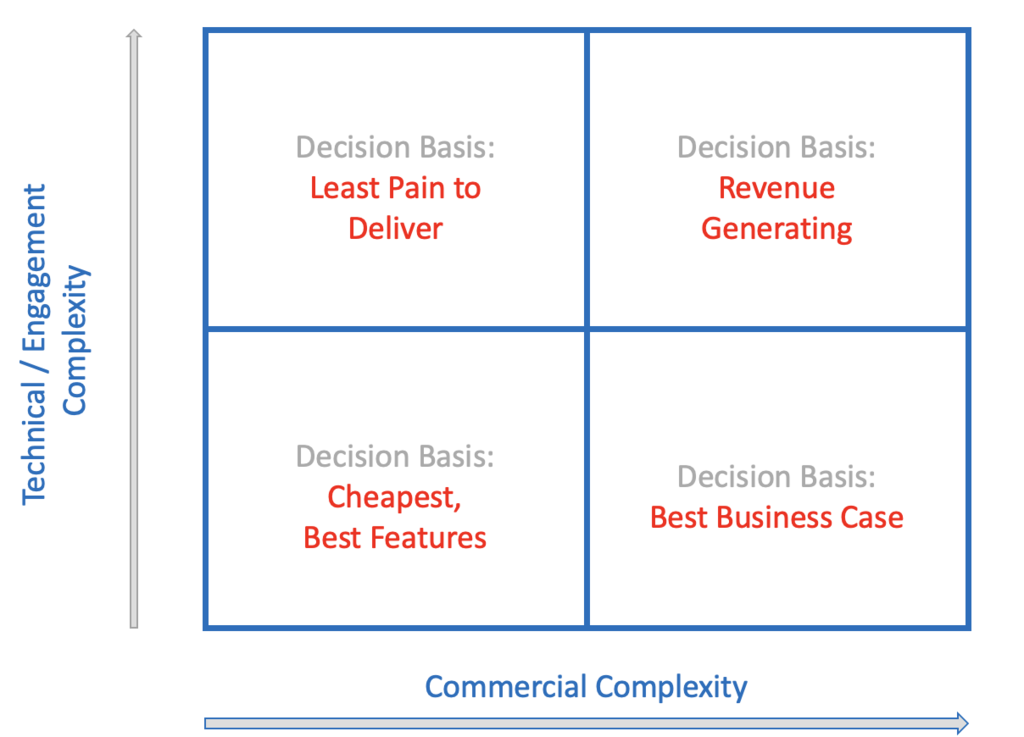

The Value Proposition will dictate the selling model. The STARPAD methodology identifies the potential target sales model and defines the approach and materials needed to support it.

Diagram 3: Identifying the Sales Model

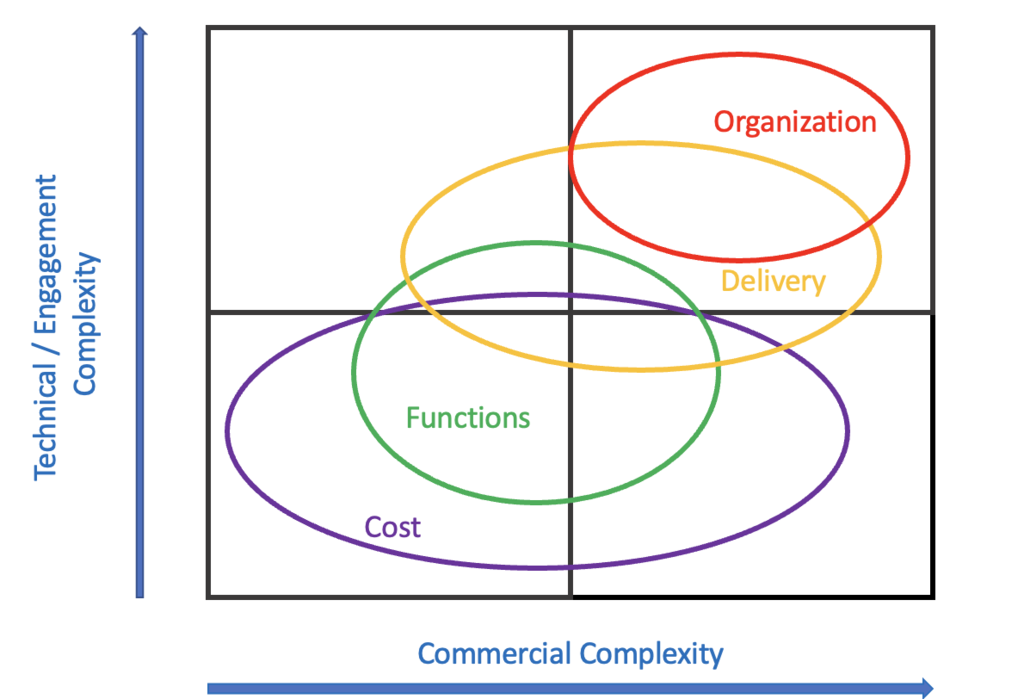

Differing Sales Models typically overlap, and indeed evolve and change over time, but all products are sold through a combination of one or more of the following:

- Cost

- Functions

- Delivery

- Organisation

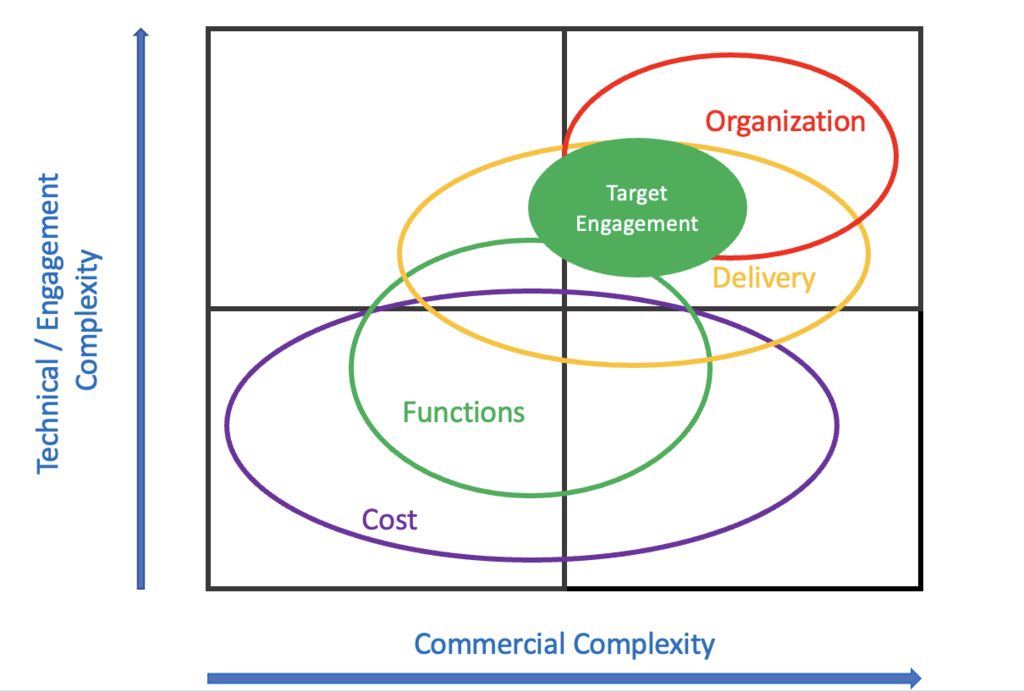

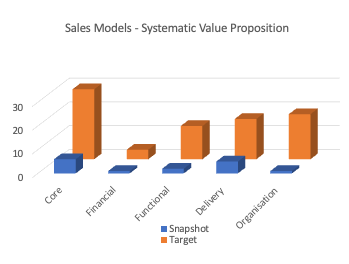

Diagram 4: The Sales Model

A real-world example of a before/after Sales engagement is shown in Diagram 5. The target sales model being very different, and significantly more strategic and engaging than that deconstructed from the existing materials and external view ie what the new customer will see.

Snapshot

Target

Diagram 5: Evolving the Sales Model

3. The Complete Package Value

The Complete Package is all the components needed for the whole sale. There are four areas that need expansion beyond the Core Product, some or all contribute to every Value Proposition, dependent upon the targeted/implemented sales model:

Financial Model

Functional Model

Delivery Model

Organizational Model

4. Minimising Pain

Every customer decision needs to balance the benefit of change against the pain of change. If there is too much pain (sometimes any pain), the decision won’t be made.

A key element of the Value Proposition is, consequently, the customer pain limitation and mitigation strategy. This is, in essence, a cross-check/sanity check on the whole Value Proposition – i.e. does it really make sense to the customer?

5. The Outputs

Assessing and aggregating the metrics derived by steps 1,2 and 3, enables us to take a systematic view of the current proposition and view its potential gains. (Theoretical maximums are unlikely to be met as no product value proposition can maximize across all measurement product areas, sectors and markets.)

As for the Sales Model review in step 2, the de-construction and analysis then detailed significant upside to the whole product functions of that same Software company: financial, functional, delivery and organizational. These are principally areas of messaging and collateral that are under the control of the business and quickly actionable.

Diagram 6: Value Proposition: Metric Comparison – Current and Target

These outputs complete the initial analysis phase of the methodology.

Growing Complex Sales - Systematically: Ranking, Prioritising and Aggregating

Once the analysis is complete, how do you move from the current state to fulfil the potential value of the product? The next stages are methodical, simple and, typically, very quick to execute.

- Ranking: The metrics are ranked by the product of highest impact and easiest implementation (most “bang for the buck”)

- Prioritizing: Actions are then identified, allocated and prioritized against available resources and capabilities.

- Aggregating: Once the Actions are completed (or at least underway), the outcomes can be aggregated to re-assess the completeness of the target value proposition.

- Delivery: Do it!

What are the likely Timeframes?

Although many stakeholders may be engaged in the creation of the Systematic Value Proposition, as it completes, it is the Sales teams and their near term customers who should impact it the most; its where the “rubber meets the road”.

The ranking of Highest Impact factored by Ease of Implementation enables quick evolution of the Value Proposition as those items that can quickly drive increased value and can be easily accomplished move up the queue.

To talk anecdotally, from a Sales perspective, the core product is what it is, i.e. harder to influence and update: The Complete Package, Messaging and Value Proposition are, comparatively, easy to amend and, critically, under the control of the customer facing teams.

Evolving Communication Challenges: New Products, Markets and Countries

Little stays constant in the software world. Companies evolve with new products, target new industries and look to enter new countries and territories.

The Core Product may stay the same, but the Complete Package and its reflective Value Proposition must change. The market demands of EMEA, say, may be very different to the US: emotional, regulatory, organization, data volume needs (to name just a few) can be different – the “packaging”, messaging and sales proposition need to evolve, but, critically, in a controlled and measurable fashion.

The same process can rapidly be deployed to optimize the solution for new releases, markets and Countries.

Growing Complex Sales - Systematically, to Messaging to Qualification to Forecasting

The ultimate importance of the Growing Complex Sales – Systematically, is that it defines the product Storyboard, subsequently driving the detail behind Qualification, Objection Handling and Forecasting, as they reflect back from a sales and customer perspective. Ideally, they should be what you measure in the sales cycle.

What are you getting?

- Clarity and Simplicity

- Systematic and Logical Methodology

- Clear prioritized Action Plan

- Consistency and Repeatability

- Bigger, Quicker, Simpler Sales